Ensuring Stability: The Security of Stablecoins

Stablecoins, pegged to fiat currencies or commodities, have become essential in the cryptocurrency space, offering stability and a bridge between traditional and digital finance. This article delves into the security considerations surrounding stablecoins, highlighting measures taken to ensure stability and build trust in these digital assets.

Understanding Stablecoins and Their Importance

Stablecoins are a category of cryptocurrencies designed to minimize price volatility, typically by pegging their value to a stable asset like a fiat currency or commodity. Their importance lies in providing a reliable medium of exchange and a store of value within the volatile world of cryptocurrencies. However, ensuring the security of stablecoins is crucial for maintaining trust among users.

Security Challenges in the Stablecoin Ecosystem

Despite their focus on stability, stablecoins face security challenges that need to be addressed. These challenges include potential vulnerabilities in smart contracts, regulatory uncertainties, and risks associated with the custodianship of underlying assets. Overcoming these challenges is paramount for fostering confidence in the stability and security of stablecoins.

Collateralization Models for Stability

Stablecoins typically employ different collateralization models to maintain their pegged value. These models include over-collateralization, where the value of the collateral exceeds the stablecoin supply, and algorithmic stablecoins, which dynamically adjust the supply based on market conditions. Each model presents its own security considerations and requires careful management to ensure stability.

Smart Contract Audits and Code Security

Many stablecoins operate on blockchain platforms using smart contracts to execute their functions. Conducting thorough smart contract audits by reputable firms is essential to identify and rectify potential vulnerabilities. Ensuring the security of the underlying code helps prevent exploits or manipulations that could compromise the stability of the stablecoin.

Regulatory Compliance in the Stablecoin Space

Regulatory compliance is a significant factor in the security of stablecoins. Adhering to financial regulations and engaging in transparent reporting practices instills confidence in users and regulatory authorities. As stablecoins operate in a regulatory gray area, establishing clear compliance measures becomes crucial for their long-term stability and acceptance.

Transparency and Reserve Audits

To build trust, stablecoin issuers often undergo regular reserve audits. These audits verify that the issuer holds sufficient assets to back the circulating supply of stablecoins. Transparent reporting of these reserves enhances user confidence, demonstrating a commitment to maintaining stability and security within the stablecoin ecosystem.

Custodial Solutions for Asset Backing

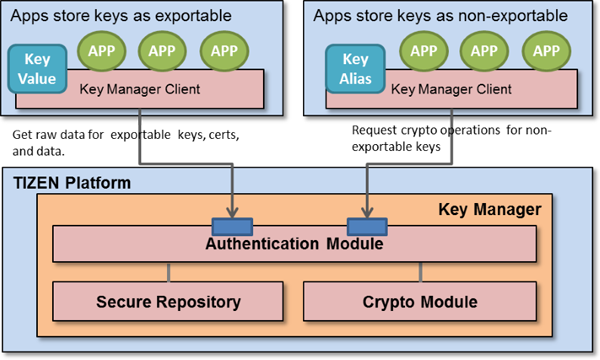

Custodial solutions play a critical role in securing the assets backing stablecoins. Trusted custodians safeguard the reserves, protecting them from theft, loss, or unauthorized access. Selecting reputable custodial services is essential to maintaining the security and integrity of the assets that provide stability to the stablecoin.

Educating Users on Risks and Best Practices

Educating users about the risks and best practices associated with stablecoins is a proactive measure to enhance security. Informing users about potential risks, secure storage practices, and the importance of due diligence in selecting stablecoin platforms contributes to a more knowledgeable and cautious user base.

Building Trust for the Future of Stablecoins

Building trust is fundamental for the future of stablecoins. As these digital assets continue to evolve, establishing transparent communication, adherence to security best practices, and collaboration with regulatory authorities are essential. Trustworthy stablecoins are more likely to gain widespread adoption and become a staple in both digital and traditional financial ecosystems.

To learn more about the security considerations in the realm of secure stablecoins, visit www.itcertswin.com. Explore the measures taken to ensure stability and build trust in these essential components of the cryptocurrency space.