Revolutionizing Insurance: The Security of Tokenized Contracts

In the ever-evolving landscape of the insurance industry, innovation is key to enhancing security, transparency, and efficiency. Secure tokenized insurance contracts have emerged as a transformative solution, reshaping the way insurance coverage is managed and ensuring a new level of trust in the digital era.

The Essence of Tokenization in Insurance

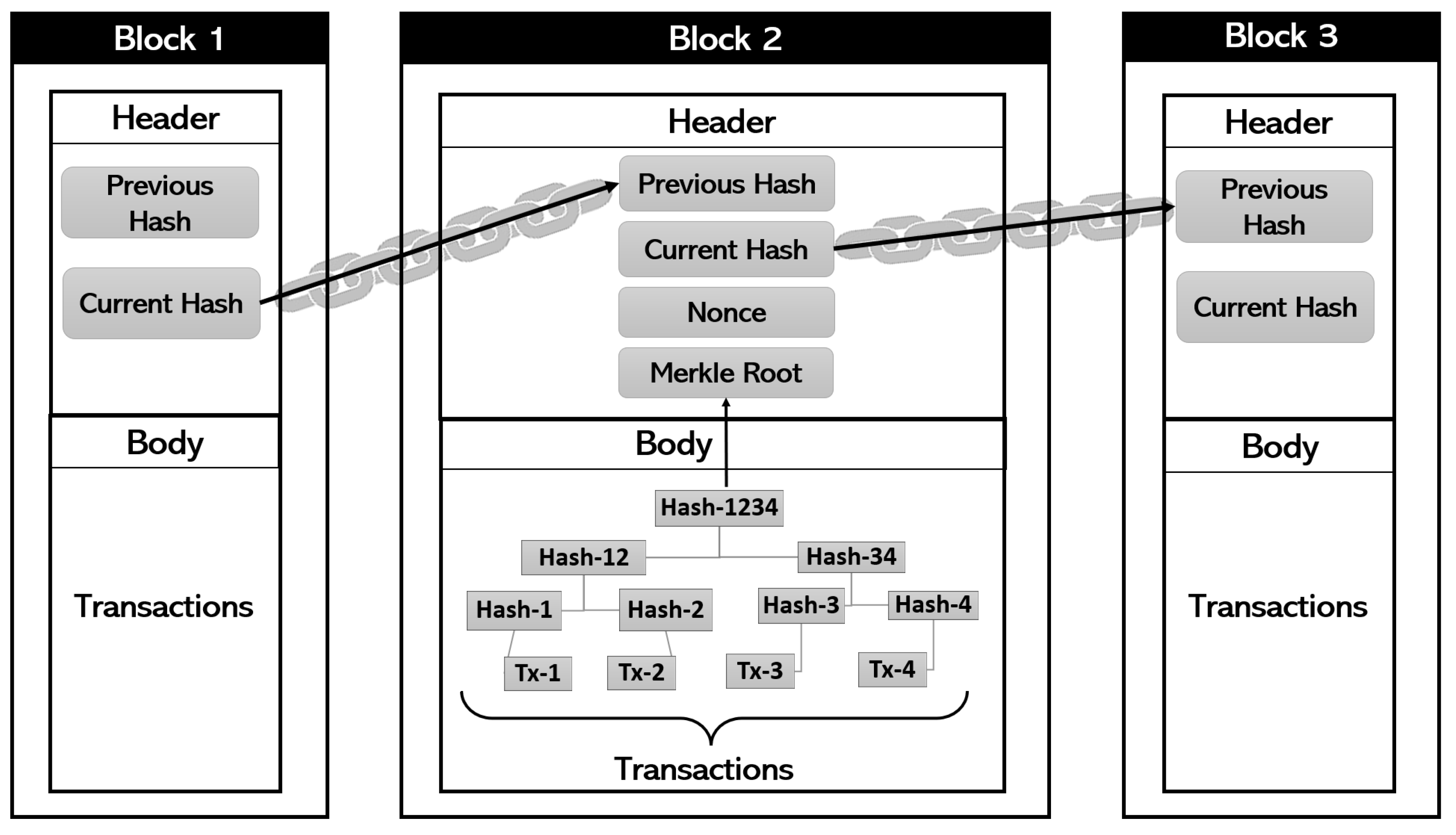

Tokenization in the insurance realm involves representing insurance contracts and policies as digital tokens on a blockchain. This innovative approach aims to address traditional challenges in the industry, offering increased security through cryptographic measures and creating a tamper-resistant record of insurance agreements.

Heightened Security Measures

Security is a paramount concern in the insurance sector, where the protection of sensitive customer information and policy details is of utmost importance. Secure tokenized insurance contracts leverage cryptographic techniques to safeguard data, making it significantly more challenging for unauthorized parties to access or manipulate sensitive information.

Efficiency in Policy Management

Tokenized insurance contracts bring efficiency to policy management processes. The digitization of policies streamlines administrative tasks, from policy issuance to claims processing. Automation and smart contract functionalities embedded in tokenized contracts reduce the administrative burden on insurance providers and enhance the overall customer experience.

Blockchain Integration for Trust and Transparency

The integration of blockchain technology further enhances the security and transparency of tokenized insurance contracts. Blockchain’s decentralized and transparent nature ensures that all parties involved in the insurance process have access to an immutable and verifiable record of the contract. This not only builds trust but also reduces disputes and fraud.

To explore the potential of secure tokenized insurance contracts, visit www.itcertswin.com.

Mitigating Fraud and Enhancing Trust

Fraudulent activities have long been a concern in the insurance industry. Tokenized insurance contracts address this challenge by providing a secure and transparent system. The immutable nature of blockchain ensures that once a contract is established, it cannot be altered, significantly reducing the risk of fraudulent claims and improving overall trust in the insurance process.

Improving Customer Experience

In the digital age, customers expect seamless and convenient interactions with service providers. Tokenized insurance contracts contribute to a more streamlined and user-friendly experience for policyholders. With simplified processes and enhanced transparency, customers can have greater confidence in their insurance coverage.

Challenges and Solutions in Implementation

While the benefits of secure tokenized insurance contracts are clear, the implementation of such innovative solutions is not without challenges. Standardization, regulatory compliance, and the integration with existing systems pose hurdles that require collaboration between industry stakeholders, regulators, and technology providers to overcome.

Future Innovations in Insurtech

As technology continues to advance, the marriage of insurance and technology, often referred to as insurtech, holds promise for further innovations. Artificial intelligence, data analytics, and decentralized applications are poised to enhance the capabilities of tokenized insurance contracts, paving the way for a more adaptive and responsive insurance industry.

Empowering Insurers and Policyholders Alike

Secure tokenized insurance contracts empower both insurance providers and policyholders. Insurers benefit from enhanced security, streamlined processes, and reduced fraud risks. Policyholders, on the other hand, gain transparency, faster claims processing, and an overall improved experience in managing their insurance coverage.

Building the Future of Digital Insurance

In conclusion, the adoption of secure tokenized insurance contracts signifies a revolutionary shift in the insurance landscape. As the industry embraces digitization, the integration of these innovative solutions becomes instrumental in building a future where security, transparency, and efficiency redefine the insurance experience for all stakeholders.

To explore the potential of secure tokenized insurance contracts, visit www.itcertswin.com. Elevate your insurance experience with the latest advancements in digital insurance solutions.