Securing Real Estate: Tokenized Transactions for the Future

In a dynamic real estate landscape, the advent of secure tokenized transactions is reshaping the way property is bought, sold, and managed. This transformative approach not only enhances security but also streamlines processes, introducing a new era in real estate transactions.

Tokenization Revolutionizing Real Estate Security

At the heart of secure tokenized real estate transactions is the revolutionary process of tokenization. By leveraging blockchain technology, properties are transformed into digital tokens. This not only enhances security by preventing unauthorized alterations but also establishes an immutable record on the blockchain, ensuring the integrity of real estate transactions.

Blockchain Security: Fortifying Real Estate Transactions

Blockchain’s inherent security features play a crucial role in the realm of secure tokenized real estate transactions. The decentralized and tamper-resistant nature of blockchain ensures that real estate transaction data remains secure and transparent. This fortified security mitigates risks associated with fraud and unauthorized changes to property terms.

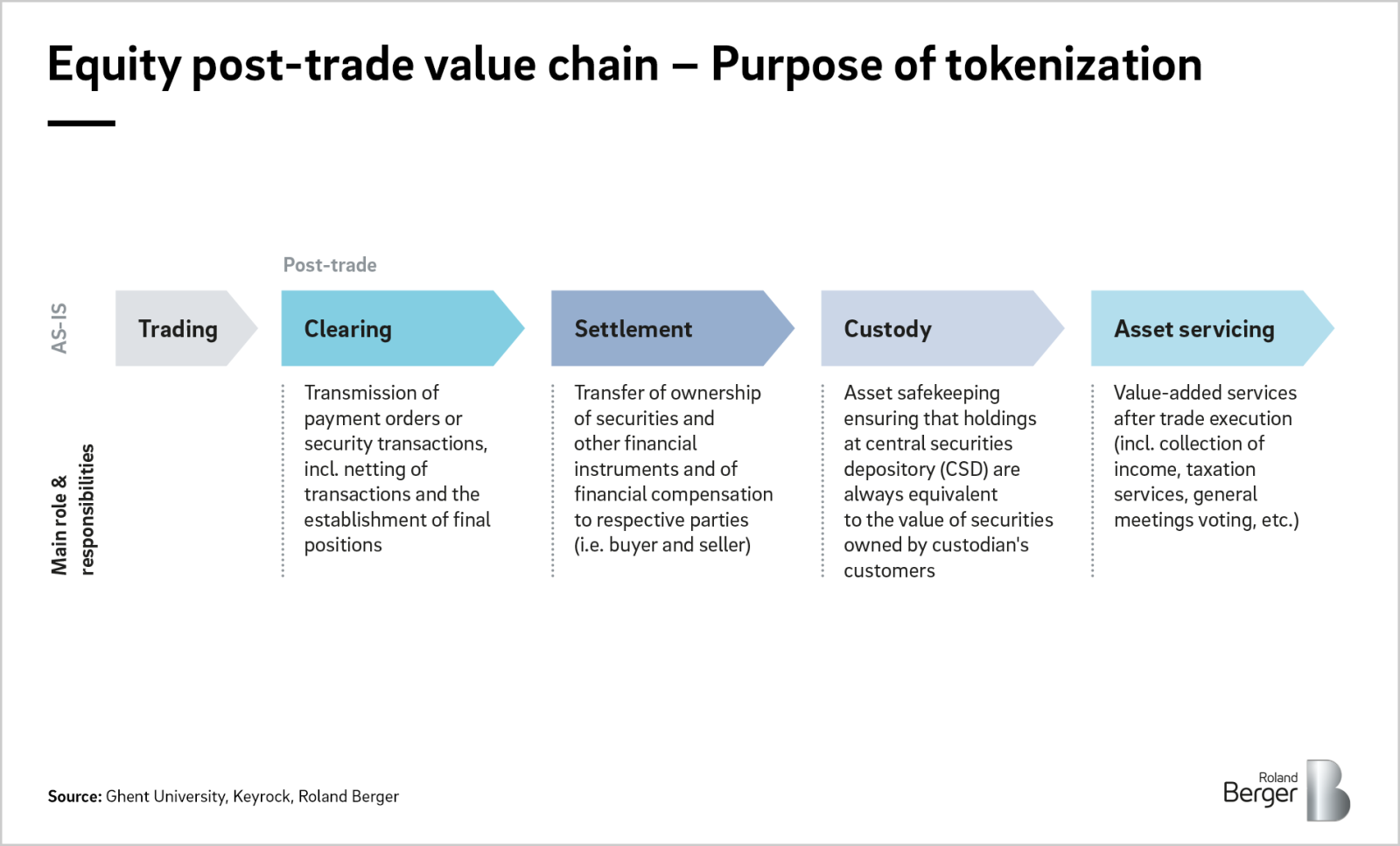

Smart Contracts: Streamlining Real Estate Execution

Embedded within secure tokenized real estate transactions are smart contracts, self-executing programs that automate the enforcement of contract terms. This automation not only streamlines the execution of real estate transactions but also reduces the need for intermediaries, ensuring that contractual obligations are met efficiently and without delays.

Decentralization in Real Estate Transaction Management

The adoption of secure tokenized real estate transactions signifies a shift towards decentralized transaction management structures. Traditional real estate transactions often involve intermediaries and multiple layers of bureaucracy. The decentralized approach empowers stakeholders by directly recording and governing real estate terms on the blockchain, fostering transparency and efficiency.

Cryptographic Security: Safeguarding Confidential Real Estate Information

The application of cryptographic principles in secure tokenized real estate transactions ensures the confidentiality of sensitive real estate information. Each party involved is assigned unique cryptographic keys, establishing a secure channel for communication and data exchange. This cryptographic layer adds an extra dimension of privacy and protection to real estate transactions.

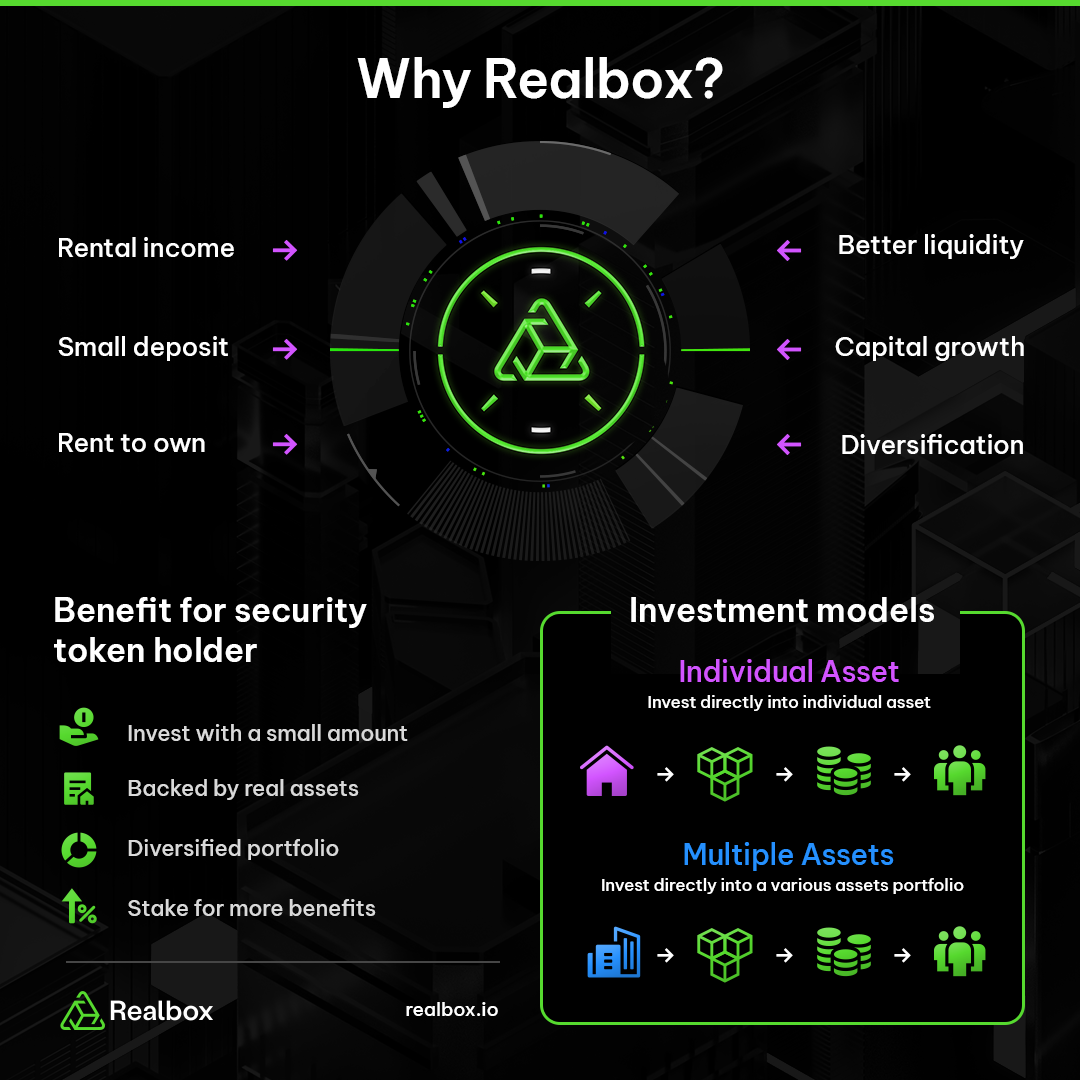

Tokenization: Transforming Real Estate Asset Representation

Tokenization not only enhances security but also redefines how real estate assets are represented. Digital tokens serve as unique, tamper-proof certificates of property terms. Secure tokenization facilitates seamless real estate transactions, providing a clear and indisputable record of property rights and obligations.

Building Trust Through Transparent Real Estate Transactions

One of the significant advantages of secure tokenized real estate transactions is the transparency they bring. All stakeholders can trace the history of a property transaction, ensuring that terms are valid and in compliance. This transparency builds trust among parties involved in the real estate process.

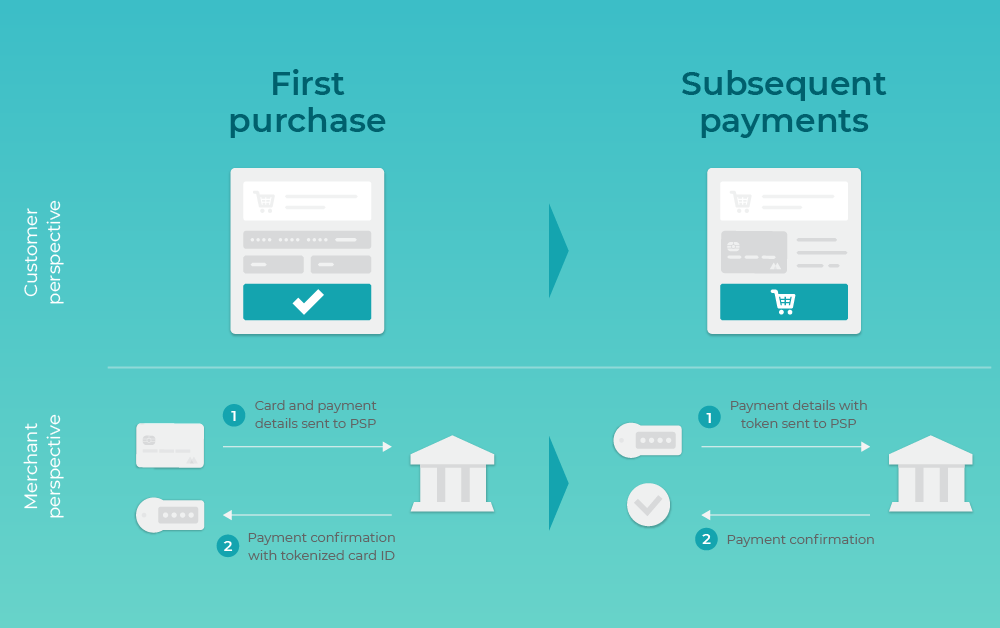

Efficiency in Real Estate Transactions

Secure tokenized real estate transactions streamline the process, reducing administrative burdens and minimizing the risk of errors. With smart contracts automating tasks such as payment processing and property transfers, stakeholders can engage in real estate transactions with confidence, knowing that the process is efficient and secure.

Embracing the Future: Secure Tokenized Real Estate Transactions

As industries adapt to technological advancements, the adoption of secure tokenized real estate transactions becomes a strategic

.png)