STOs: Elevating Security in Digital Investment

Security Token Offerings (STOs) have emerged as a significant evolution in the world of digital investment, introducing a level of security and regulatory compliance previously lacking in the cryptocurrency space. This article delves into the intricacies of STOs, exploring their characteristics, benefits, and the impact they bring to the landscape of fundraising and investment.

Understanding STOs

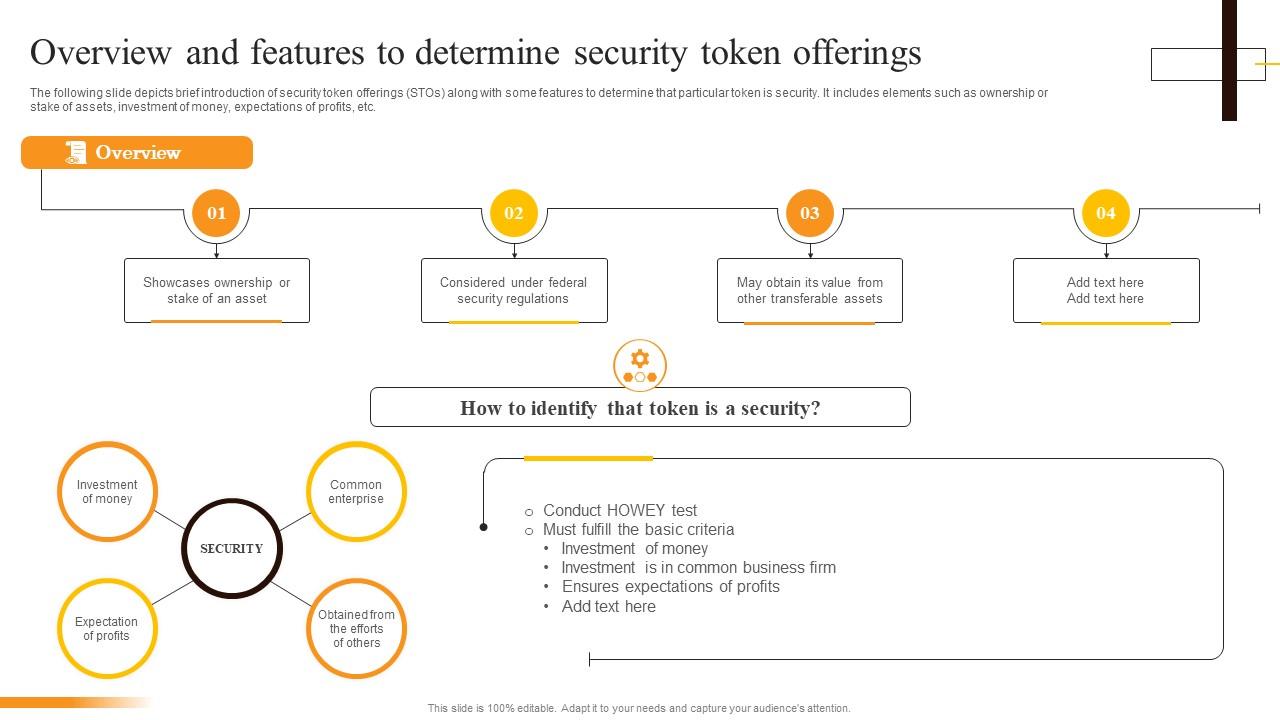

STOs represent a fundraising method where digital tokens, backed by real-world assets like equity, profit-sharing agreements, or tangible assets, are offered to investors. Unlike utility tokens, which grant access to a project’s services, security tokens issued through STOs are considered financial securities. This distinction brings a layer of regulatory compliance and investor protection to the forefront.

Regulatory Compliance and Investor Protection

One of the defining features of STOs is their adherence to regulatory frameworks governing securities. This regulatory compliance ensures that STOs operate within legal boundaries, providing a heightened level of investor protection compared to some previous fundraising models. The inclusion of security tokens as regulated financial instruments marks a significant step toward legitimacy and accountability.

Explore the characteristics and benefits of Security Token Offerings (STOs) in digital investment.

Asset-Backed Security Tokens

STOs are often associated with asset-backed security tokens, where each token represents a share or ownership stake in a tangible asset. This asset-backed nature provides investors with a more transparent and tangible link to the value of their investment, fostering trust and confidence in the digital investment landscape.

Accessibility and Fractional Ownership

STOs maintain the principles of blockchain technology by offering fractional ownership of high-value assets. Investors can purchase and trade fractions of security tokens, enabling a more inclusive and accessible investment model. This fractional ownership structure aligns with the broader goal of democratizing access to investment opportunities.

Global Market Accessibility

Similar to Initial Coin Offerings (ICOs), STOs benefit from blockchain’s global accessibility. However, the regulatory compliance associated with STOs often provides a more secure and transparent environment for investors. This global market accessibility allows projects to attract a diverse range of investors from different corners of the world.

Liquidity and Automation Through Smart Contracts

STOs leverage the advantages of blockchain-powered smart contracts to automate various processes. These self-executing contracts facilitate tasks such as dividend payments, profit-sharing, and compliance procedures, enhancing the efficiency of transactions. Additionally, the liquidity of security tokens is improved, allowing for easier buying and selling on secondary markets.

Challenges and Evolving Ecosystem

While STOs offer a promising approach to digital investment, challenges persist. Regulatory variations across jurisdictions, the need for standardization, and educating both issuers and investors about the intricacies of STOs contribute to an evolving ecosystem. Overcoming these challenges is essential for the widespread adoption of STOs.

Security Token Offerings (STOs) present a paradigm shift in digital investment. Dive deeper into their impact and possibilities on itcertswin.com.

Conclusion: A New Era of Digital Securities

STOs mark a new era in the evolution of digital securities, combining the benefits of blockchain technology with regulatory compliance and investor protection. As the ecosystem