The Revolutionary Impact of R3 Corda Blockchain

In the ever-evolving landscape of financial technology, R3 Corda Blockchain emerges as a transformative force, revolutionizing the way transactions are conducted and managed. This article delves into the various facets of R3 Corda Blockchain, exploring its innovative features, real-world applications, and potential to reshape global finance.

Introduction to R3 Corda Blockchain: Redefining Transactions

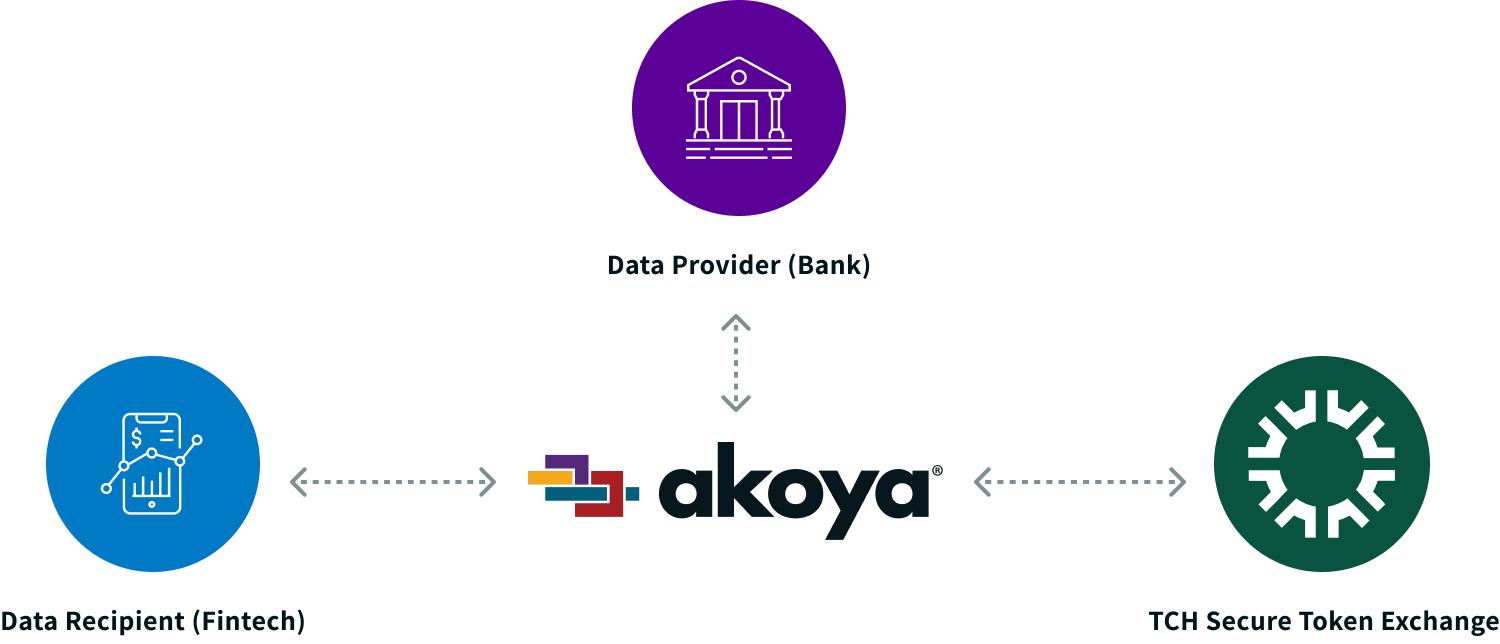

R3 Corda Blockchain, developed by the consortium R3, is a distributed ledger platform designed specifically for businesses. Unlike public blockchains like Bitcoin and Ethereum, Corda is built to address the unique needs of enterprises, offering privacy, scalability, and interoperability for complex financial transactions.

The Core Principles of R3 Corda Blockchain

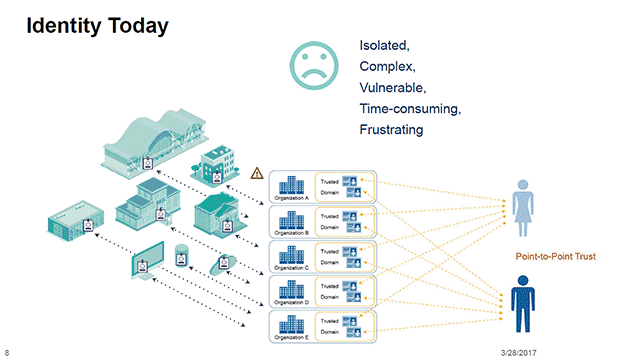

At its core, R3 Corda Blockchain operates on the principles of privacy and permissioning. Each Corda network is permissioned, meaning participants must be invited to join and have explicit access to the network. This ensures that sensitive financial data remains confidential and only accessible to authorized parties.

Features and Functionality of R3 Corda Blockchain

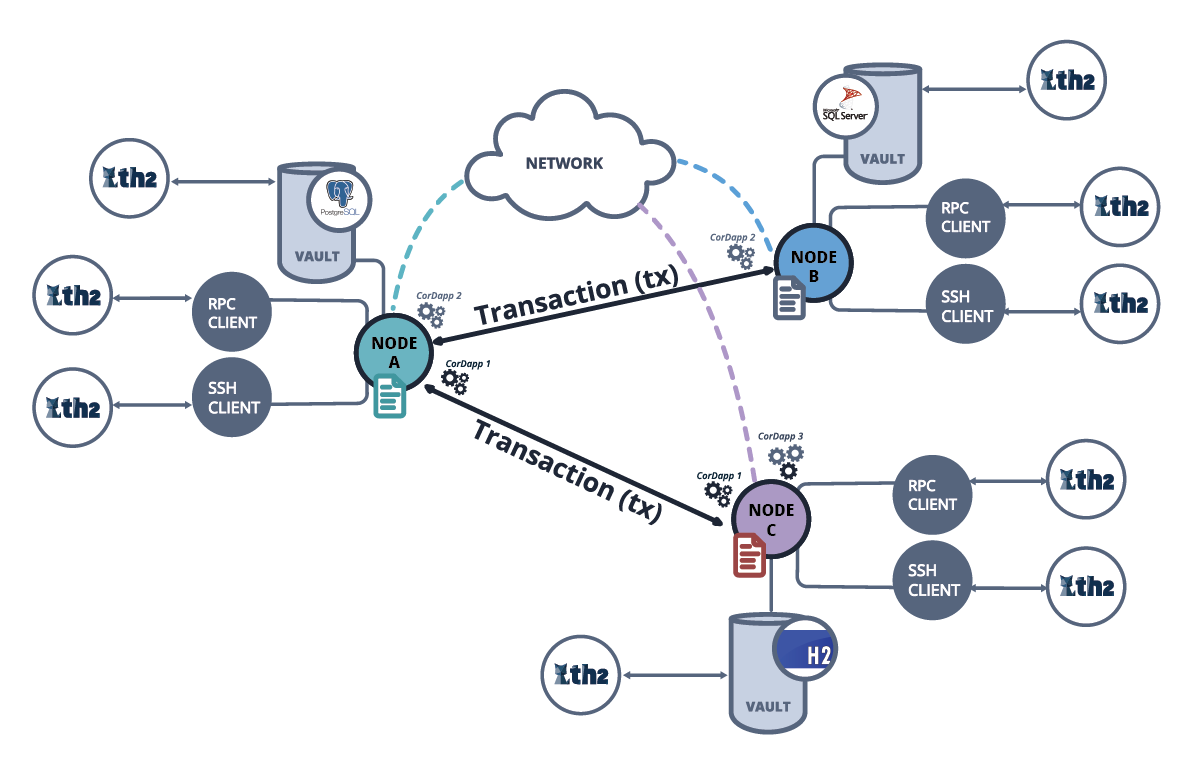

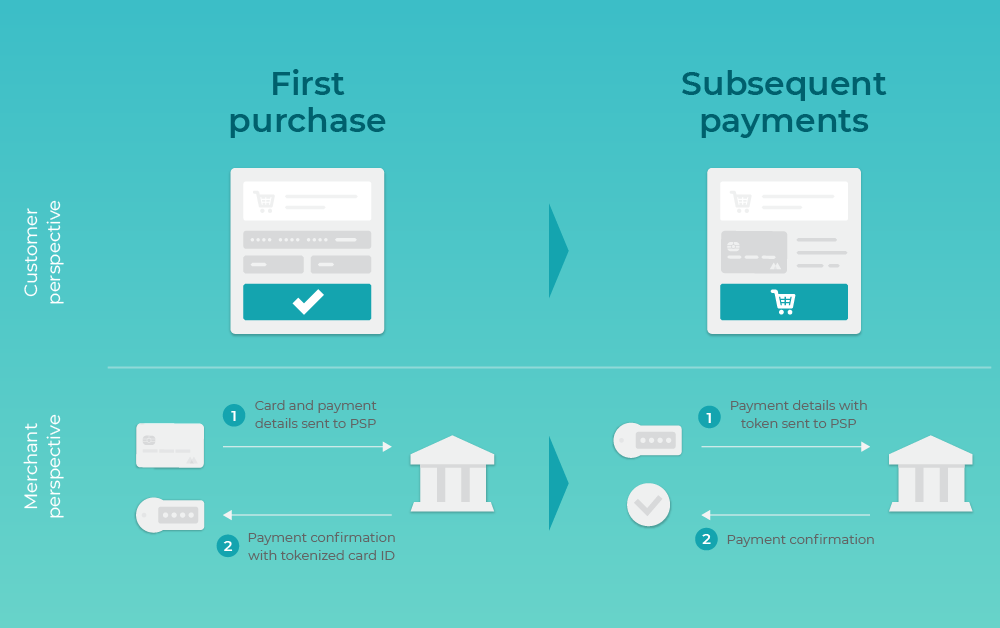

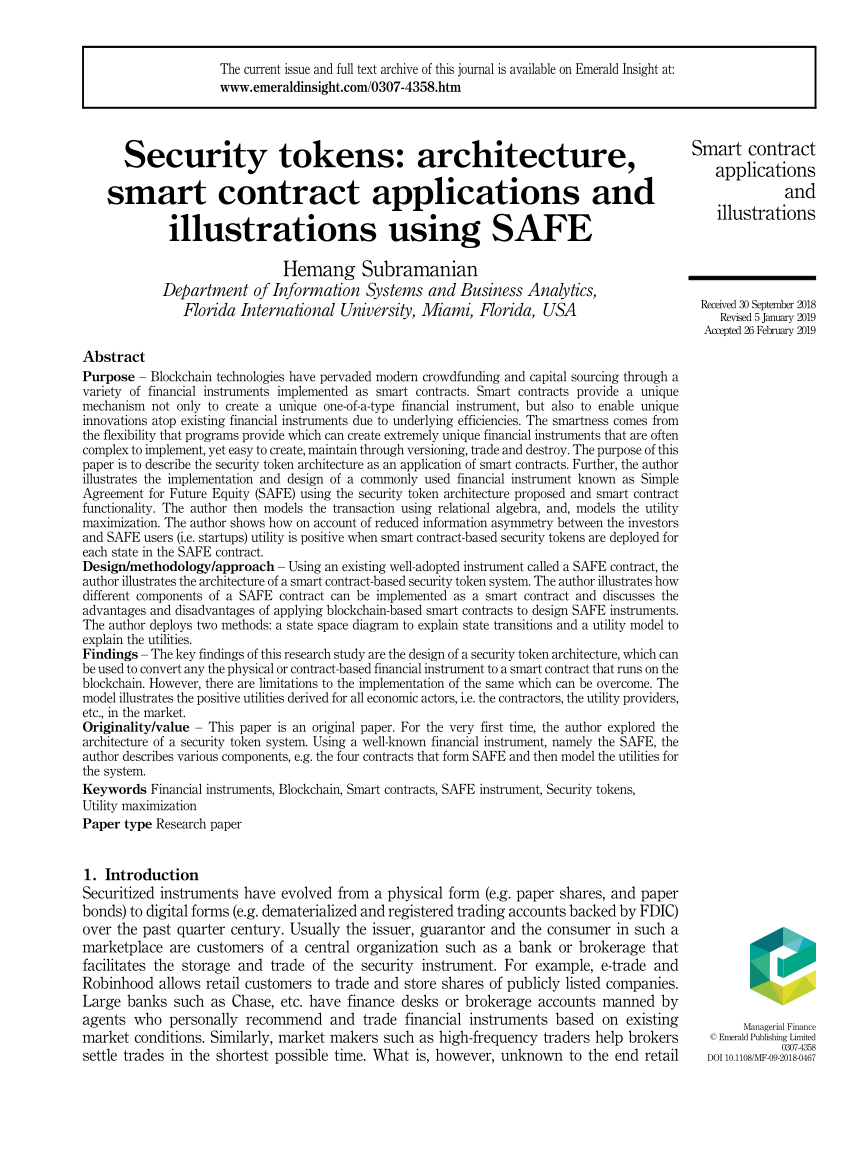

R3 Corda Blockchain boasts a wide range of features designed to facilitate secure and efficient transactions. Smart contracts, or “CorDapps,” enable parties to automate complex agreements and execute transactions with greater speed and accuracy. Corda’s unique consensus mechanism ensures that transactions are validated only by relevant parties, reducing the need for costly intermediaries.

Real-World Applications of R3 Corda Blockchain

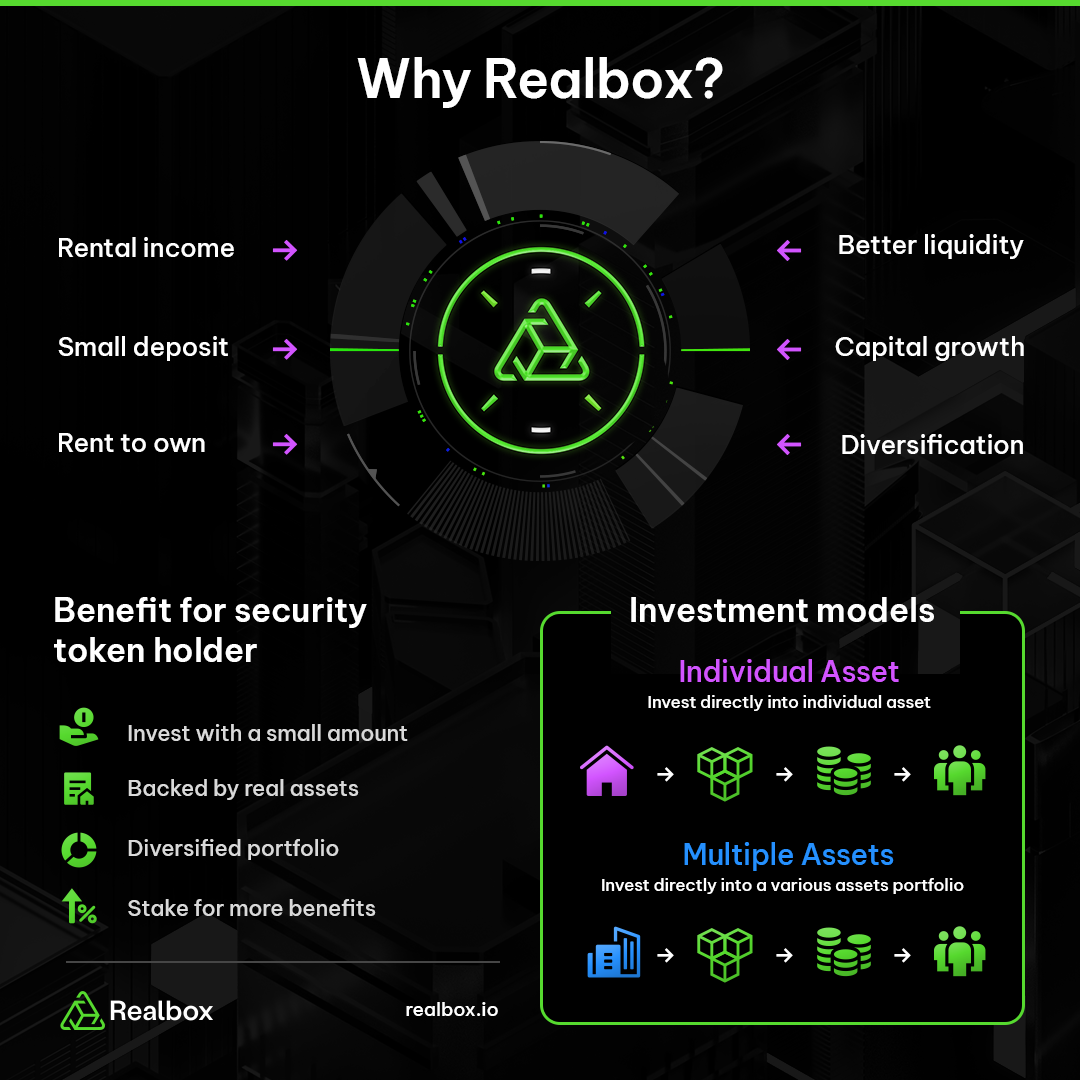

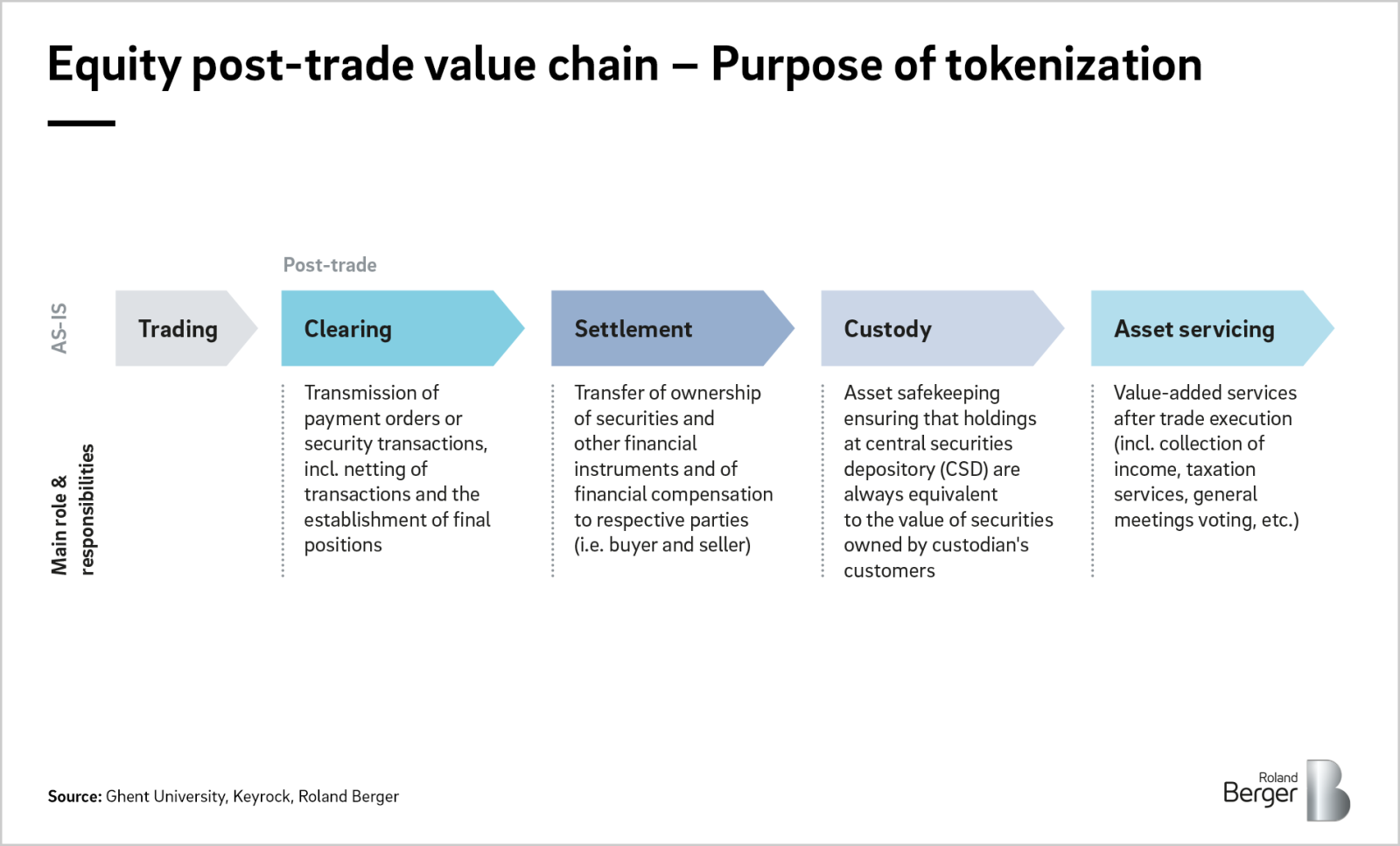

From trade finance to supply chain management, R3 Corda Blockchain has a myriad of real-world applications across various industries. Financial institutions can leverage Corda to streamline processes such as trade settlement and reconciliation, while healthcare providers can use Corda to securely exchange patient data and streamline administrative tasks.

Advantages of R3 Corda Blockchain: A Closer Look

One of the key advantages of R3 Corda Blockchain is its focus on privacy and confidentiality. Unlike public blockchains, where transactions are visible to all participants, Corda ensures that sensitive information remains private and only shared on a need-to-know basis. This makes Corda particularly well-suited for industries where data privacy is a priority.

Challenges and Opportunities for R3 Corda Blockchain

Despite its many advantages, R3 Corda Blockchain faces challenges on its path to widespread adoption. Interoperability with other blockchain networks, regulatory compliance, and network scalability are among the key hurdles that must be addressed. However, with ongoing development and collaboration within the Corda community, these challenges can be overcome, unlocking Corda’s full potential.

The Future of Finance with R3 Corda Blockchain

As the financial landscape continues to evolve, R3 Corda Blockchain stands at the forefront of innovation, driving forward the adoption of blockchain technology in traditional finance. With its focus on privacy, scalability, and interoperability, Corda has the potential to revolutionize the way we transact and interact in the digital age, paving the way for a more efficient, transparent, and inclusive financial ecosystem. Read more about r3 corda blockchain

.png)