Navigating the Landscape of Secure DeFi Platforms

The decentralized finance (DeFi) revolution has ushered in a new era of financial inclusivity, allowing users to engage in various financial activities without relying on traditional intermediaries. As the popularity of DeFi platforms continues to soar, it becomes crucial to delve into the importance of security measures that fortify these decentralized financial ecosystems.

Understanding the DeFi Landscape

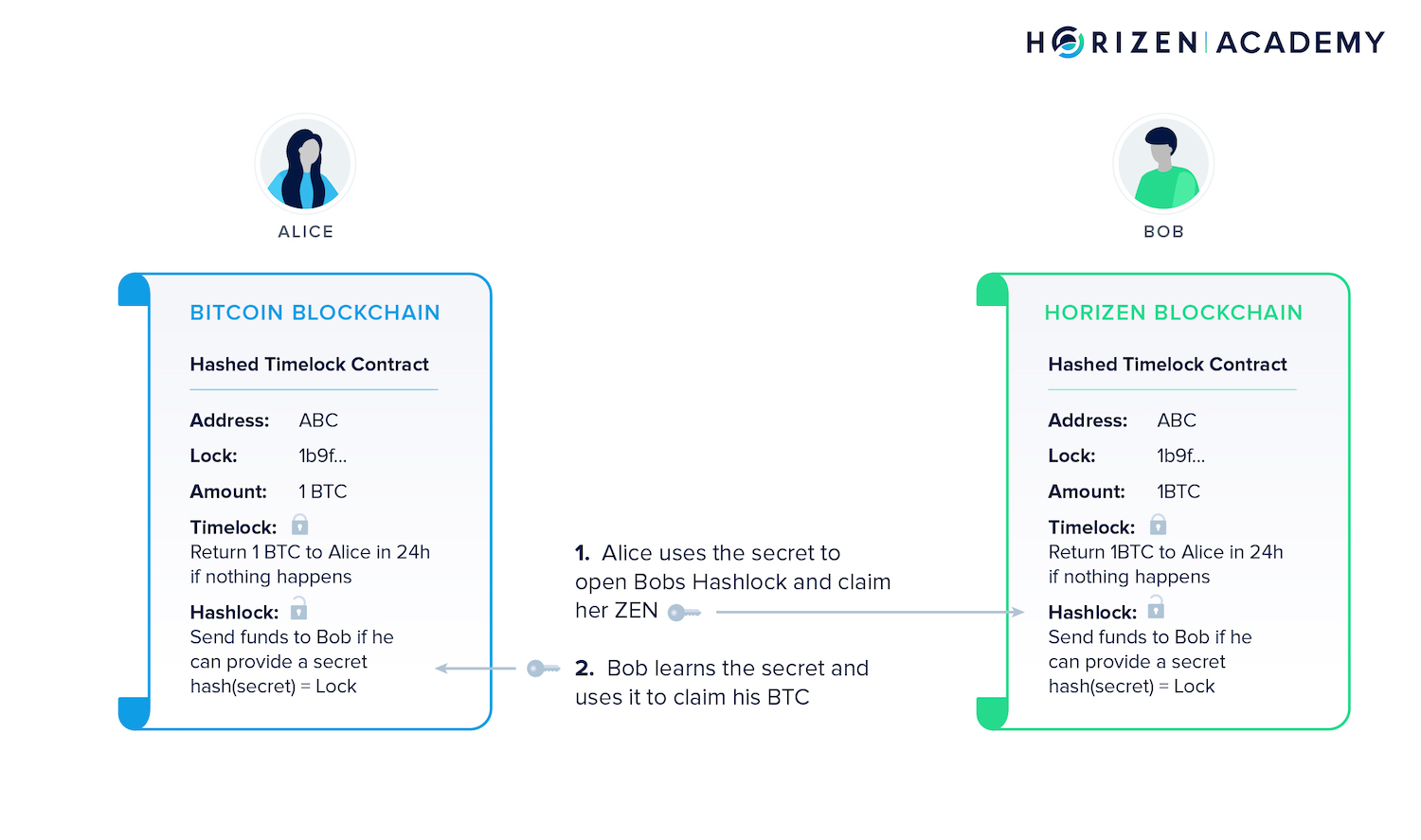

Decentralized finance platforms encompass a range of financial services such as lending, borrowing, trading, and yield farming, all facilitated through smart contracts on blockchain networks. While the potential benefits are immense, the decentralized nature of these platforms introduces unique challenges, particularly in terms of security.

The Significance of Smart Contract Security

Smart contracts, the self-executing contracts with the terms directly written into code, form the backbone of DeFi platforms. Ensuring the security of these smart contracts is paramount. Rigorous auditing, continuous monitoring, and the use of established coding best practices contribute to fortifying the resilience of these contracts against potential vulnerabilities.

Decentralization as a Security Pillar

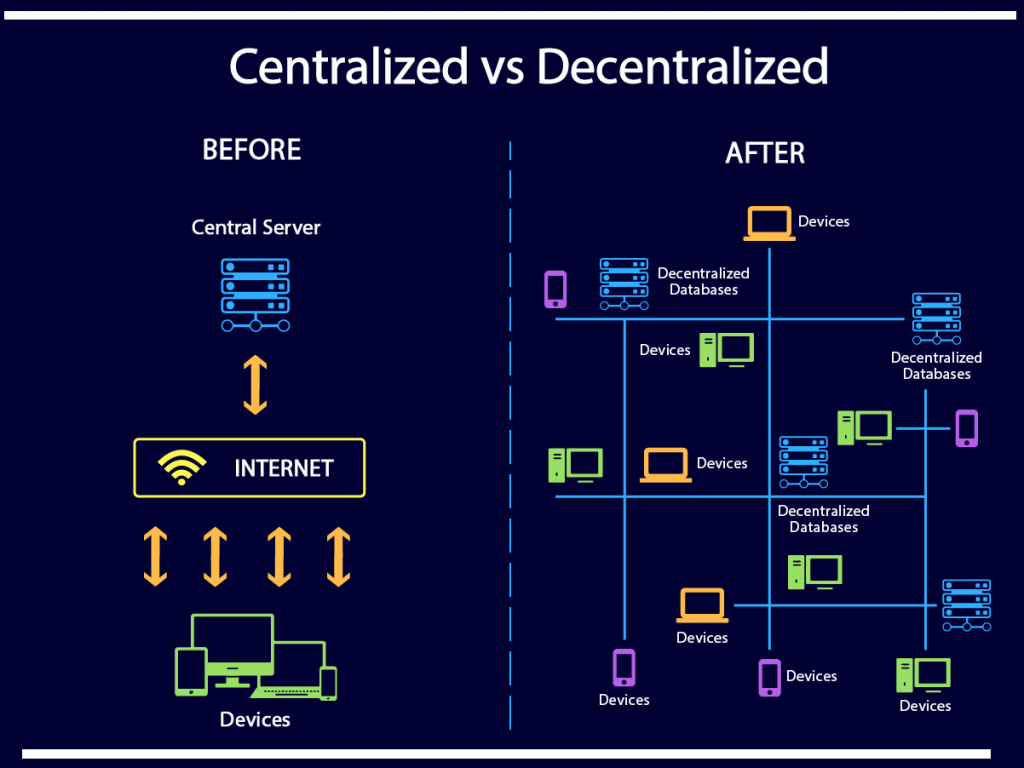

Decentralization is a core tenet of DeFi platforms, offering increased security by eliminating single points of failure. In a decentralized system, there is no central authority vulnerable to hacking or manipulation. The distributed nature of decision-making and data storage enhances the overall security posture of the platform.

Secure Asset Management

One of the key features of DeFi platforms is the ability to manage digital assets securely. Implementing robust security measures for wallets, including multi-signature authentication and hardware wallet integration, ensures that users have control over their assets and minimizes the risk of unauthorized access.

Risk Management and Audits

Comprehensive risk management strategies, including regular audits, are critical for the sustained security of DeFi platforms. Audits conducted by reputable third-party firms help identify vulnerabilities, ensuring that potential weaknesses are addressed before they can be exploited by malicious actors.

Decentralized Governance for Security Enhancement

Decentralized governance models empower the community to actively participate in the decision-making processes of DeFi platforms. By allowing users to have a say in protocol upgrades and changes, these platforms enhance transparency and reduce the likelihood of governance-related security issues.

Real-Time Monitoring for Swift Responses

The dynamic nature of the cryptocurrency space demands real-time monitoring. DeFi platforms must implement sophisticated monitoring tools to detect anomalies, potential attacks, or irregularities promptly. Swift responses to emerging threats contribute to maintaining a secure environment for users.

User Education: A Pillar of DeFi Security

Educating users about the risks and security best practices within the DeFi ecosystem is crucial. Awareness campaigns, tutorials, and user-friendly guidelines contribute to a more informed user base capable of navigating the intricacies of decentralized finance securely.

Regulatory Compliance in DeFi

As DeFi platforms gain mainstream attention, navigating regulatory landscapes becomes increasingly important. Platforms that prioritize regulatory compliance not only ensure a secure environment but also pave the way for broader acceptance and integration within traditional financial systems.

The Future of DeFi Security

In conclusion, the security of decentralized finance platforms is foundational to their success and continued