Expanding the Realm of Possibilities: Sidechains Blockchain

Blockchain technology continually evolves, and one innovation that stands out is the concept of sidechains. This article explores sidechains in the blockchain landscape, diving into their definition, implementation, advantages, and their transformative impact on the broader blockchain ecosystem.

Understanding Sidechains: An Overview:

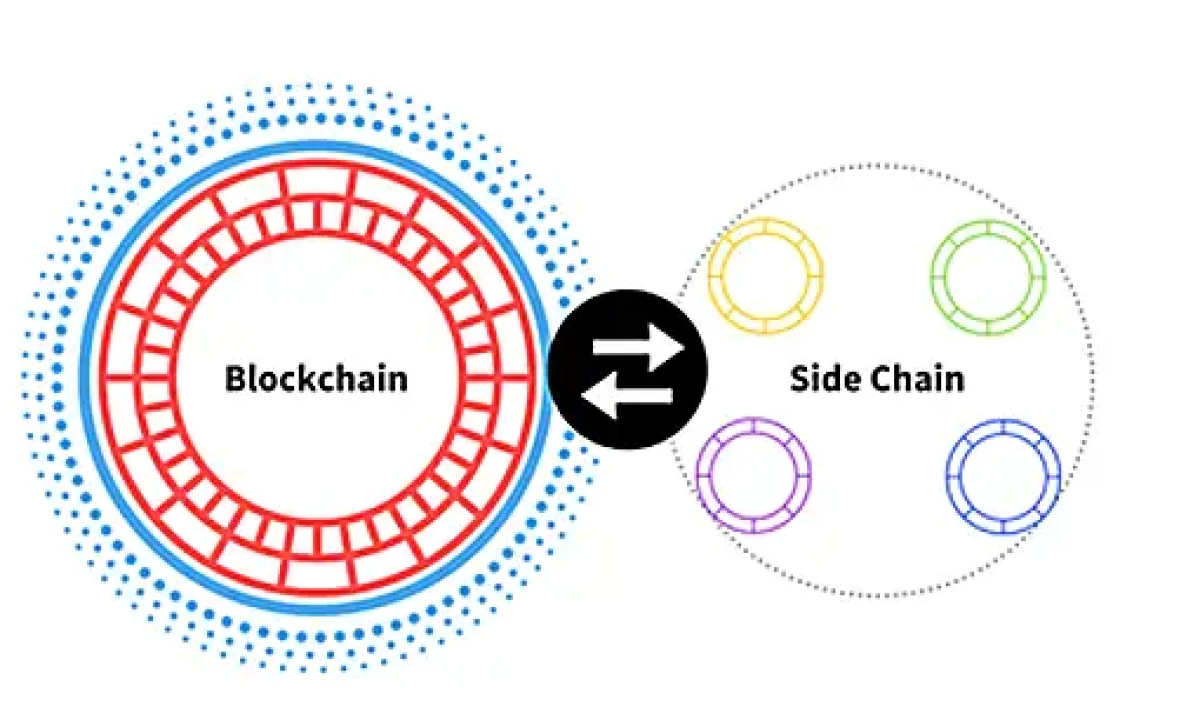

Sidechains are additional blockchains that operate alongside the main blockchain, allowing for the creation of interoperable, specialized chains. These sidechains can have their unique rules and features while being connected to the main blockchain, enabling the transfer of assets and data between them. The goal is to introduce flexibility and scalability to the blockchain network.

In the realm of blockchain education, platforms like Sidechains Blockchain serve as valuable resources, offering insights into the intricacies of sidechains. These platforms cater to both newcomers and seasoned blockchain enthusiasts, providing a comprehensive understanding of how sidechains contribute to the evolution of decentralized systems.

How Sidechains Work: Bridging the Main Chain:

Sidechains operate by using two-way pegs, mechanisms that lock assets on the main blockchain, allowing an equivalent amount to be released on the sidechain. This ensures a secure and verifiable connection between the main chain and the sidechain. The assets on the sidechain can then be used independently according to its specific rules before being transferred back to the main chain if needed.

Advantages of Sidechains: Enhancing Blockchain Flexibility:

One of the primary advantages of sidechains is their ability to enhance the flexibility of blockchain networks. By creating specialized chains with unique features or consensus mechanisms, developers can experiment with new ideas without directly impacting the main chain. This flexibility encourages innovation and allows for the customization of blockchain solutions to meet specific needs.

Scalability: Alleviating Network Congestion:

Scalability is a persistent challenge in blockchain networks, and sidechains offer a potential solution. By offloading certain transactions or activities to sidechains, the main blockchain can alleviate congestion and improve overall scalability. This approach allows for a more efficient use of resources while maintaining the security and decentralization of the main chain.

Use Cases and Applications: Tailoring Solutions to Specific Needs:

Sidechains unlock a range of use cases and applications across various industries. From finance to supply chain management, developers can design sidechains to address specific requirements. For example, a financial institution might implement a sidechain to facilitate faster and more cost-effective transactions without overburdening the main blockchain.

Interoperability: Fostering Collaboration between Chains:

Interoperability is a key feature of sidechains, enabling collaboration between different blockchains. Assets and data can seamlessly move between the main chain and various sidechains, fostering a more interconnected blockchain ecosystem. This interconnectedness opens up new possibilities for cross-chain functionalities and collaborative projects.

Security Considerations: Ensuring a Trustless Environment:

While sidechains offer advantages, security considerations are paramount. The two-way peg mechanism must be robust to prevent any compromise of assets moving between the main chain and sidechains. Additionally, the consensus mechanisms and security features of sidechains need careful design to ensure a trustless environment across the entire interconnected system.

Challenges and Limitations: Balancing