Revolutionizing Art Investments: The Promise of Tokenized Security The world of art, traditionally characterized by exclusivity and high barriers to…

Read More

Revolutionizing Art Investments: The Promise of Tokenized Security The world of art, traditionally characterized by exclusivity and high barriers to…

Read More

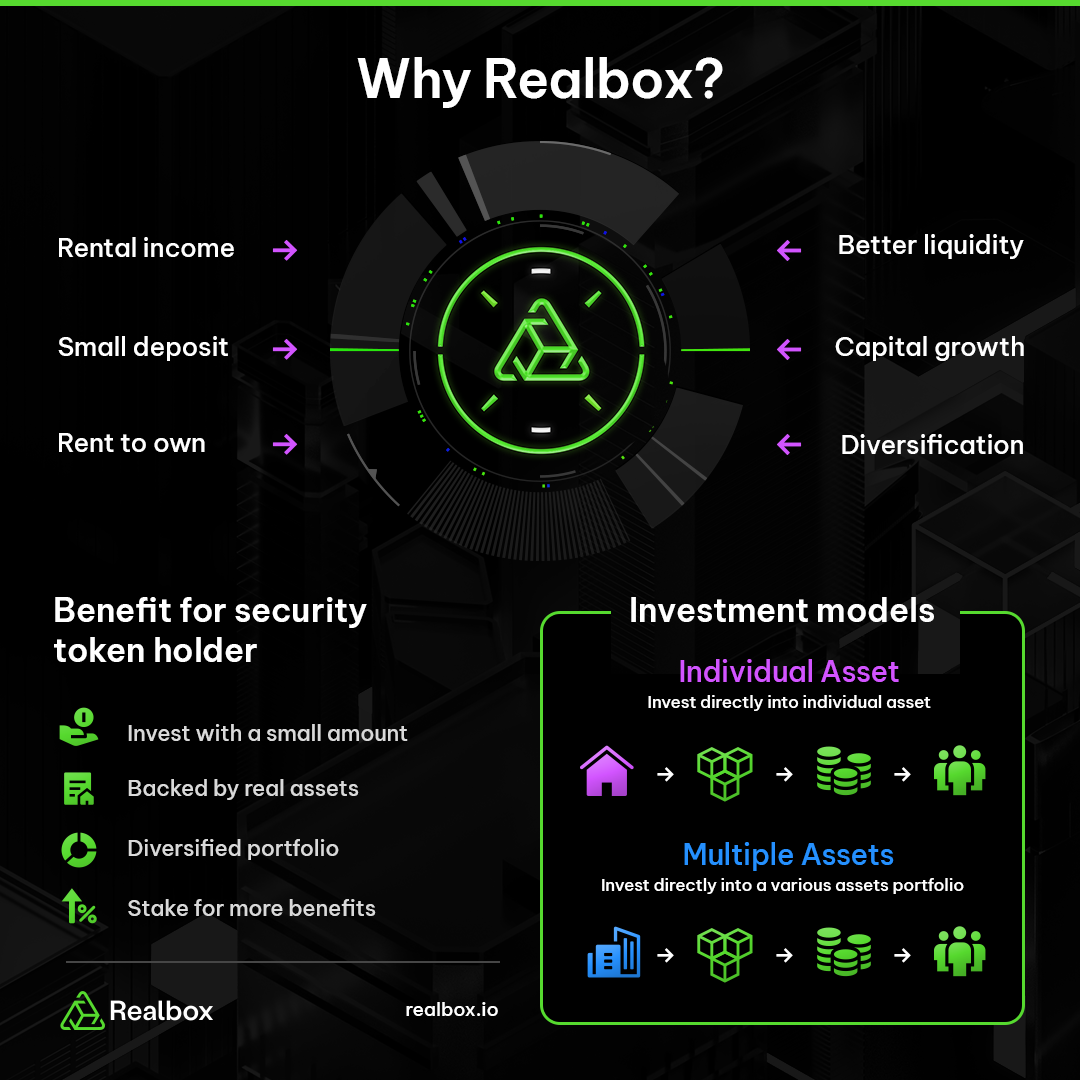

Transforming Real Estate: The Power of Tokenized Security In the dynamic landscape of real estate, innovation continues to reshape traditional…

Read More