Introduction Welcome to the world of AI and machine learning! In this article, we’ll delve into the fundamentals of mastering…

Read More

Introduction Welcome to the world of AI and machine learning! In this article, we’ll delve into the fundamentals of mastering…

Read More

Introduction: In a world where smartphones are a necessity, finding the perfect device that seamlessly integrates into our lives is…

Read More

Decoding Smart Contract Oracles: Enhancing Blockchain Functionality Understanding Smart Contract Oracles In the realm of blockchain technology, smart contracts play…

Read More

Introduction: Redefining Affordable Performance In a world where smartphones seem to be getting more expensive by the day, Samsung is…

Read More

Elevating Everyday Living with Innovation: Exploring Smart Home 008 Introducing Smart Home 008: Revolutionizing Home Automation In the fast-paced world…

Read More

Embracing Innovation at Sandbox Adidas A New Era in Athletic Apparel Sandbox Adidas represents a shift in the world of…

Read More

Exploring the Potential of RSK Blockchain Introduction: Understanding RSK Blockchain In the world of cryptocurrency, RSK Blockchain stands out as…

Read More

Subheading: Introducing the Samsung 25W Charger In today’s fast-paced world, where our devices are essential for both work and play,…

Read More

Revolutionizing Your Living Space with Smarthome008 Introduction to Smarthome008: A New Era of Home Automation In the realm of home…

Read More

Exploring SEI Crypto: Redefining the Landscape of Digital Finance Understanding SEI Crypto SEI Crypto emerges as a prominent player in…

Read More

Immersive Adventures Await with Reality Pro VR Headset Exploring the World of Virtual Reality In recent years, virtual reality (VR)…

Read More

Sirin Labs Coin: Revolutionizing Cryptocurrency Security Introduction: In a world where digital transactions reign supreme, security is paramount. Enter Sirin…

Read More

Inside the Life of Quinton Griggs: TikTok Star The Rise of Quinton Griggs Quinton Griggs, a name that resonates with…

Read More

Microgrid Renewable Energy: Powering Local Communities Empowering Local Energy Solutions Microgrid renewable energy systems are revolutionizing the way communities generate…

Read More

Understanding Hydrogen Electrolyzer Cost: Factors and Considerations The cost of hydrogen electrolyzers is a crucial factor in determining their viability…

Read More

Empowering Sustainability: Decentralized Eco-Friendly Blockchain Technology The Rise of Decentralized Solutions In recent years, decentralized eco-friendly blockchain technology has emerged…

Read More

Revolutionizing Energy Infrastructure: Exploring Renewable Energy System Design Renewable energy system design stands as a beacon of innovation in the…

Read More

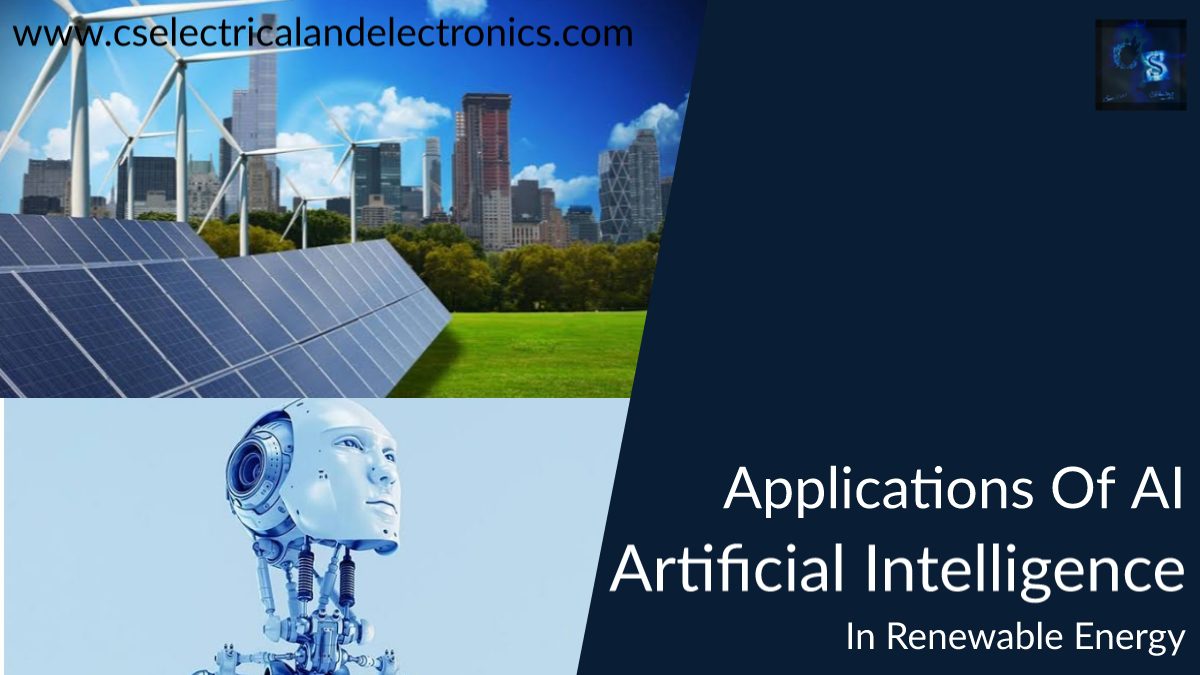

Revolutionizing Renewable Energy with Artificial Intelligence Renewable energy has long been touted as a key solution to combat climate change…

Read More

Elevating Gaming Security: The Age of Secure Blockchain Games In the dynamic world of gaming, the integration of blockchain technology…

Read More

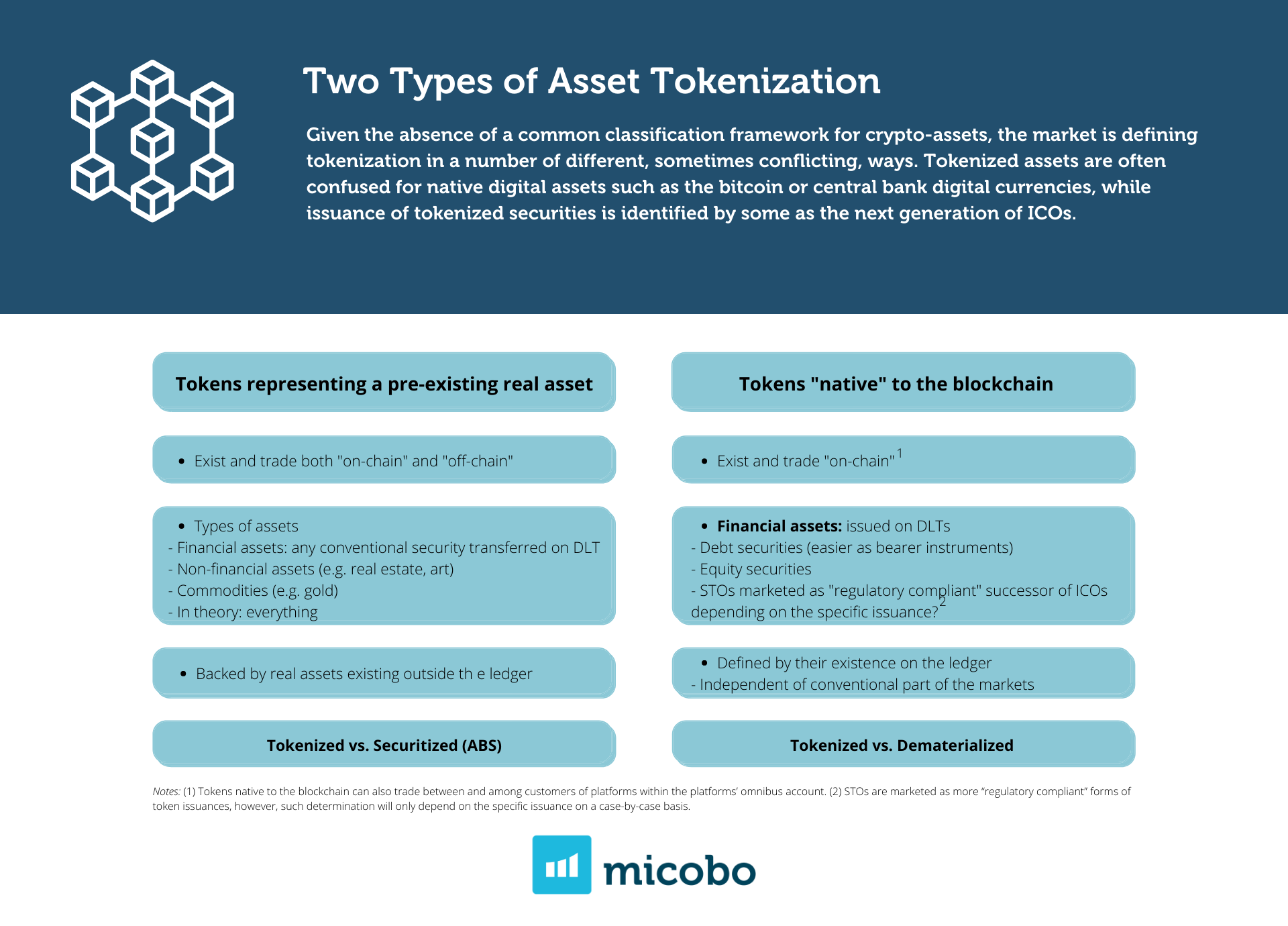

Revolutionizing Finance: Security in Tokenized Financial Instruments In the dynamic realm of finance, the digitization of assets and transactions is…

Read More

Fortifying Digital Asset Custody: A Security Imperative Digital asset custody plays a crucial role in the evolving landscape of cryptocurrencies…

Read More

Exploring Trustworthy Transactions: Secure Borrowing on the Blockchain Decentralized finance (DeFi) has revolutionized traditional lending and borrowing systems by leveraging…

Read More

In the ever-evolving landscape of digital assets, Non-Fungible Tokens (NFTs) have emerged as a revolutionary form of ownership and representation.…

Read More

Securing Tokenized Securities: Trust in Digital Investments Tokenized securities, representing traditional financial assets on blockchain, have gained traction for their…

Read More