Exploring Quorum Crypto: Revolutionizing Digital Transactions

The Evolution of Quorum Crypto

In the fast-paced world of digital finance, Quorum Crypto has emerged as a trailblazer, revolutionizing the way we conduct transactions. Born out of the need for secure, efficient, and transparent financial systems, Quorum Crypto represents the next evolution in blockchain technology.

A Closer Look at Quorum Crypto

At its core, Quorum Crypto is a blockchain platform designed to facilitate secure and efficient digital transactions. Developed by J.P. Morgan, Quorum Crypto combines the security and immutability of blockchain with the speed and scalability required for enterprise-level applications.

Innovations in Finance

One of the key innovations of Quorum Crypto is its focus on privacy and confidentiality. Unlike public blockchains like Bitcoin or Ethereum, Quorum Crypto offers private transactions, ensuring sensitive financial information remains secure and confidential.

Driving Efficiency in Finance

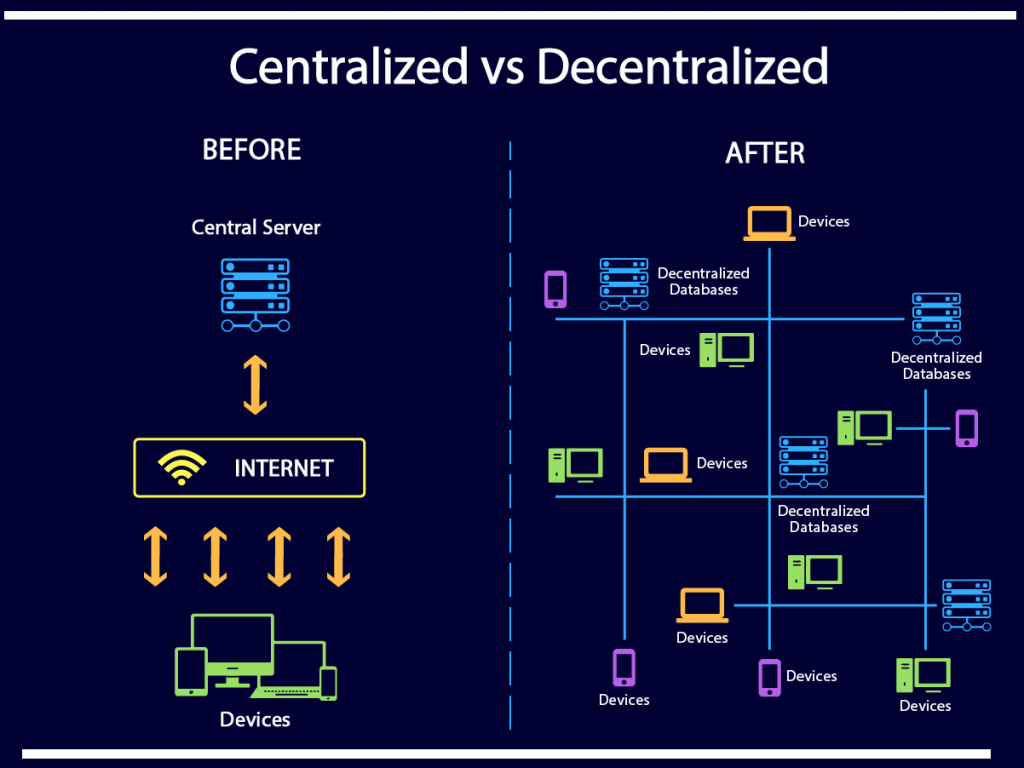

Quorum Crypto is also designed to improve the efficiency of financial transactions. By leveraging blockchain technology, transactions can be settled in near real-time, eliminating the need for intermediaries and reducing costs associated with traditional banking systems.

Empowering Financial Inclusion

Another important aspect of Quorum Crypto is its potential to empower financial inclusion. By providing access to secure and efficient financial services, Quorum Crypto has the potential to bring banking services to the unbanked and underserved populations around the world.

Building Trust Through Technology

Trust is essential in any financial transaction, and Quorum Crypto aims to build trust through technology. By providing a transparent and immutable record of transactions, Quorum Crypto ensures that all parties can trust the integrity of the financial system.

Enhancing Transparency in Finance

Transparency is another key feature of Quorum Crypto. Unlike traditional financial systems, which can be opaque and difficult to understand, Quorum Crypto provides a transparent and auditable record of all transactions, helping to prevent fraud and improve accountability.

The Future of Digital Currency

As the world becomes increasingly digital, the future of finance is undoubtedly digital currency. Quorum Crypto is at the forefront of this revolution, providing the infrastructure and technology needed to support the widespread adoption of digital currency.

Innovating the Way We Transact

With its focus on privacy, efficiency, and transparency, Quorum Crypto is innovating the way we transact. Whether it’s sending money across borders or executing complex financial transactions, Quorum Crypto is poised to transform the way we conduct business.

Empowering Global Transactions

Finally, Quorum Crypto has the potential to empower global transactions. By providing a seamless and secure platform for conducting transactions across borders, Quorum Crypto can help facilitate trade and commerce on a global scale, driving economic growth and prosperity for all. Read more about quorum crypto