DeFi Security: Safeguarding the Decentralized Financial Landscape

Decentralized Finance (DeFi) has garnered immense popularity for its innovative approach to financial services. However, with the rise of DeFi, security concerns have become a focal point. This article explores the intricacies of DeFi security, shedding light on the challenges, measures, and the evolving landscape of safeguarding decentralized financial ecosystems.

The DeFi Revolution

DeFi represents a revolutionary shift in the financial industry by leveraging blockchain technology to provide decentralized alternatives to traditional financial services. From lending and borrowing to decentralized exchanges and liquidity provision, DeFi platforms offer users unprecedented access and control over their financial activities.

Security Challenges in DeFi

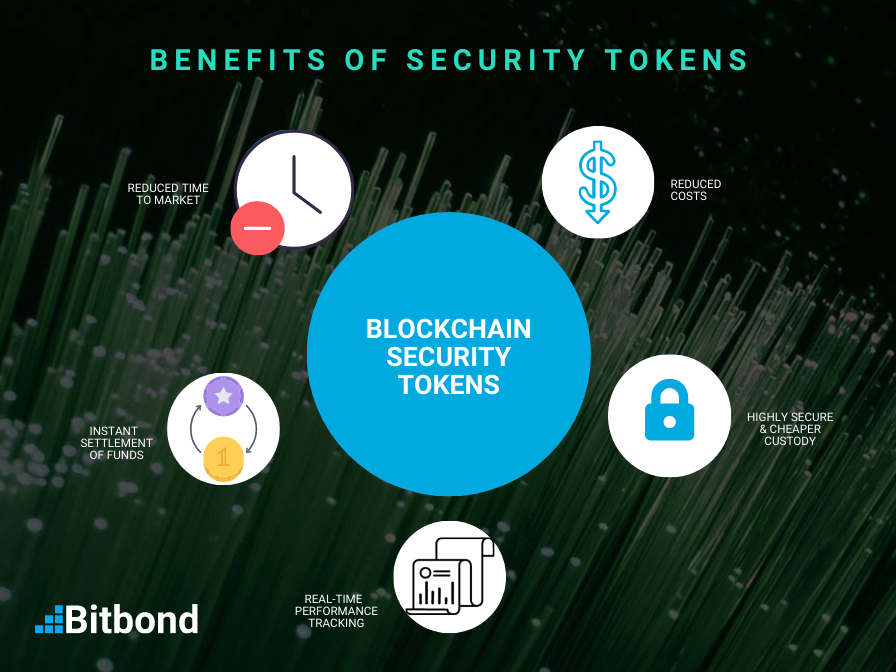

The decentralized nature of DeFi, while offering advantages, also introduces unique security challenges. Smart contract vulnerabilities, protocol exploits, and governance issues are among the concerns that can be exploited by malicious actors. As DeFi platforms handle significant value, securing these protocols becomes paramount.

Explore the intricacies of DeFi Security and the challenges it faces in the decentralized financial landscape.

Smart Contract Audits and Code Reviews

Smart contracts serve as the backbone of DeFi protocols, executing automated functions without intermediaries. Conducting thorough smart contract audits and code reviews is a crucial step in identifying and mitigating vulnerabilities. Engaging with reputable audit firms helps ensure the integrity and security of the underlying code.

Decentralized Governance Security

Decentralized governance is a core feature of many DeFi projects, allowing token holders to participate in decision-making processes. However, ensuring the security and effectiveness of decentralized governance mechanisms poses challenges. Implementing secure and transparent governance models is essential to prevent manipulation and exploitation.

Liquidity Pool Security Measures

DeFi platforms often rely on liquidity pools to facilitate trading and lending activities. Securing these pools against impermanent loss, flash loan attacks, and manipulation is essential. Platforms employ various security measures, such as dynamic pricing algorithms and decentralized oracle solutions, to enhance the resilience of liquidity pools.

Insurance and Risk Mitigation

Given the dynamic nature of DeFi, insurance solutions have emerged to mitigate the impact of potential security breaches. Users and projects can obtain coverage against smart contract vulnerabilities and protocol failures. Integrating insurance mechanisms provides an additional layer of protection for participants in the DeFi ecosystem.

Education and User Awareness

Enhancing user education and awareness is a proactive approach to bolstering DeFi security. Educated users are better equipped to assess risks, utilize security features, and make informed decisions when engaging with DeFi platforms. Continuous efforts to educate the community contribute to a more secure decentralized financial landscape.

Decentralized Finance (DeFi) security is a critical aspect of the evolving financial landscape. Delve deeper into the measures and challenges on itcertswin.com.

Conclusion: Navigating the Future of Finance Securely

As DeFi continues to reshape the financial landscape, security remains a pivotal concern. Addressing the challenges through rigorous audits, robust governance models, and user education is imperative for the sustainable growth of decentralized finance. By prioritizing security measures, DeFi can continue to innovate and offer a secure alternative for users seeking financial services outside